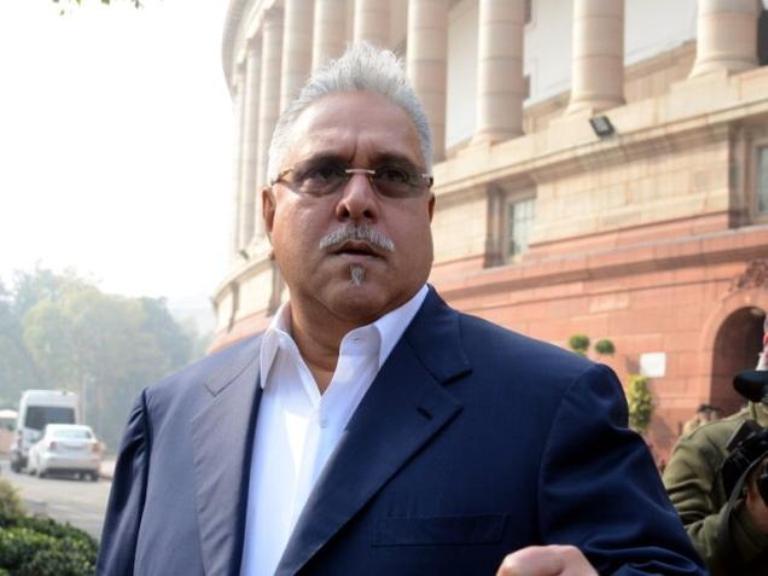

PMLA case against Mallya: Enforcement Directorate (ED) will soon file its first charge sheet in the Vijay Mallya-IDBI bank alleged loan default money laundering case. ED will include statements from various executives and investigation of assets and transaction of the accused of the two organisations.

PMLA case against Mallya: ED has started scrutiny records filed by CBI in the court

ED officials said it has already begun accumulated the records related to the matter and will soon be scrutinised a similar record filed by the CBI in a court here last week.

Once the charge sheet is filled by the ED, it will go on to strengthen India’s expulsion request against Mallya from the UK as the CBI charge sheet has already smoothed the way for his handover, they said.

The investigation report in this case, said, accessed by PTI has said “The money trail analysis revealed that out of the loan of Rs 860.92 crore, sanctioned and disbursed by IDBI, Rs 423 crore has been remitted out of India. The said payments were shown to be made towards aircraft rental leasing and maintenance, servicing and spare parts.”

The investigations conducted so far, it said, found KFA along with IDBI bank officials “criminally conspired to obtain funds to the tune of Rs 860.92 crore despite weak financials, negative net-worth, non-compliance of corporate credit policy of new client, non-quality collateral security and low credit rating of the borrower, out of which Rs 807.82 crore of principal amount remains unpaid”.

Ed registered criminal case in this deal last year under the PMLA Act

ED had registered a criminal case in this deal last year under the provisions of the Prevention of Money Laundering Act (PMLA) and has attached assets to the tune of Rs 9,661 crore till now.

The agency’s probe also found that the considered brand valuation of the KFA, taken as a collateral by the bank for loan security in the said case, was not a sound decision.

“Investigation revealed that KFA brand was accepted as collateral security and the valuation for Kingfisher brand as accepted by the bank as Rs 3,400 crore without independent verification,” it said, adding the firm that did the brand valuation had submitted three different amounts of this estimate between 2008-12.

“Thus, it indicates how volatile is this (brand value) intangible fictitious asset and needs to be evaluated frequently, particularly in aviation sector which itself is very unpredictable and was going through a very rough phase and brand valuation was wholly based on projections provided by Ms KFA. “Hence, it would not be prudent to accept brand value of 2008, while considering loan sanction in 2009,” it said.