AP government offers subsidy: To encourage people towards digital payments, Andhra Pradesh government has decided to offer Rs 1,000 as a subsidy to the people at the time of purchasing smartphones. The scheme is specially designed for Small merchants, non-tax assesses and a cash transaction tax on withdrawals of Rs 50,000 and above in banks.

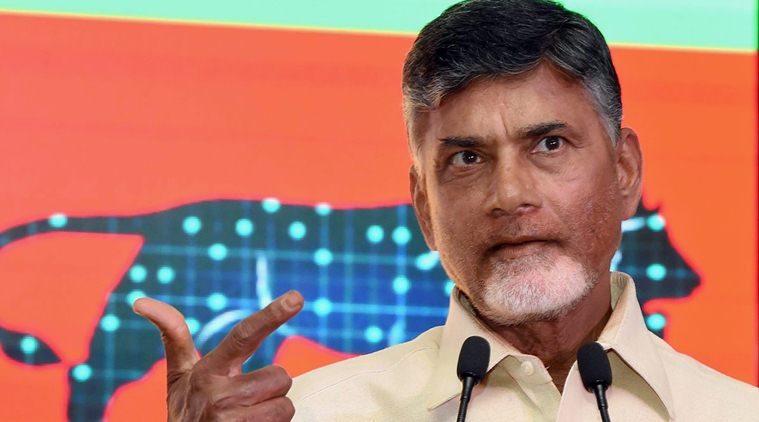

This has been recommended by the chief minister’s panel. Chief Minister Panel’s report was sent to Prime Minister Office by committee representative CM N Chandra Babu Naidu. He has also made a case of lower/zero merchant discount rate (MDR) for every digital payment to government entities and imposed a limitation on cash in all type big ticket transactions.

Committee has suggested Centre to promote AEPS without charging MDR

Bank will be charged Merchant Discount Rate from merchants for providing debit and credit card services.

Maharashtra Chief Minister Devendra Fadnavis and Madhya Pradesh Chief Minister have also asked Center to promote Aadhaar Enabled Payment System while providing incentives and not charging MDR.

The other recommendation proposed by the committee including tax incentives for Micro ATMs, biometric sensors etc and tax refund for costumers using online transaction up to a certain proportion of annual income.

AP government offers subsidy: Digital transaction will reduce the cost of printing currency, says Naidu

When questioned CM Naidu how sure he was about the incorporation of this recommendation in the forthcoming budget on February 1, he said “I am very confident about that.

Describing benefits of digital transactions, he said that printing currency is quite expensive as it requires a lot of handling charges and security, whereas there is no need of such cost for the digital currency.

There is a huge opportunity in India to reduce the cost if the volume of digital transitions would increase as non-cash payment transitions by non-banker per capita per annum is 11 in the country as compared to,786 in Singapore, 26 in China,355 in the UK and 142 Brazil.

On the other hand, the panel has made a case for relief in prospective taxes to motivate merchants to accept digital payments and there will be no retrospective taxation to merchants while doing digital payments.