The GST Council, which has the responsibility to fix the GST rates, began 2-day deliberations in the New Delhi. And the Council has finalised a 4-tier tax structure ranging from 5% to 28% under a proposed Goods and Services Tax (GST) with some tinkering of the Centre’s proposal.

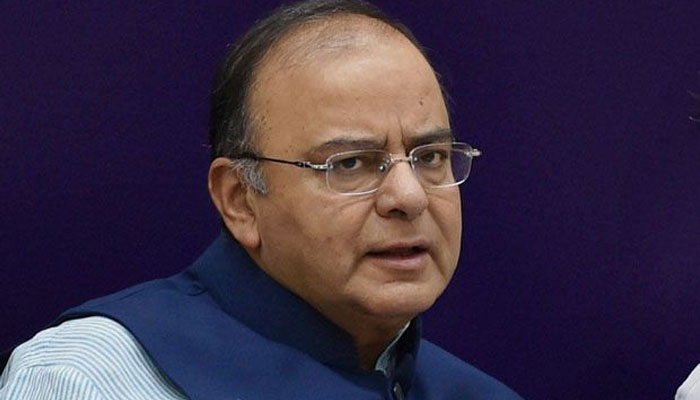

Arun Jaitley announced that four-tier GST rate structure of 5, 12, 18, 28 percent has been decided. Union Finance Minister said zero-tax rate to apply to 50% of items in CPI basket, including foodgrains used by common man.

How and what tax rates will be applied on various goods under Finalised GST Rates?

5 Percent duty will be levied on items of mass consumption used by common people; 2 standard rates of 12 and 18 percent will be there in GST.

Arun Jaitley said, “Four-tier GST rate structure of 5%, 12%, 18%, 28% has been decided by the GST Council,” Finance minister Arun Jaitley said. He added that “Considering the inflation impact of having one standard rate, there’ll be 2 standard rates of 12% and 18%.”

Items taxed at 30-31% (excise plus VAT) will be taxed at 28%, clarified Arun Jaitley. Additional revenue from highest tax slab to be used to keep essential use items at 5 percent and transferring common use items to 18 percent, said Jaitley.

Arun Jaitley also made it clear that aerated drinks, Pan masala, luxury cars, tobacco products to be taxed higher than 28%. The long-delayed tax, which would transform Asia’s third largest economy into a single market, is expected to boost revenues through better compliance while making life simpler for the business that now pays a host of federal and state levies.

Will Government succeed to roll-out GST by April 1, 2017?

The meeting is to sort out the issues concerning tax rate to enable Parliament to approve the Central GST (CGST) and Integrated GST (IGST) legislations in the Winter Session beginning November 16 and pave the way for the rollout of the new indirect tax regime from April 1 next year.

On the issue of dual control or cross empowerment, it is likely that there would be a generic line in the CGST Bill regarding jurisdiction of centre and states on taxes. The final touches would be given by GST Council.

Arun Jaitley will seek parliamentary approval for bills later this month that would set the rate and scope of the GST. State assemblies must also approve similar bills for the tax to enter force as planned next April 1.