A while back, Prime Minister Modi announced the demonetization of the higher denomination currency notes – Rs.500 and 1000. He discontinued theses currency notes out of the blue after an announcement. This created a nationwide panic as everyone was money starved. All the cash they had was nothing but a piece of paper; banks and ATMs were closed. PayTM came to the rescue in the need of the hour.

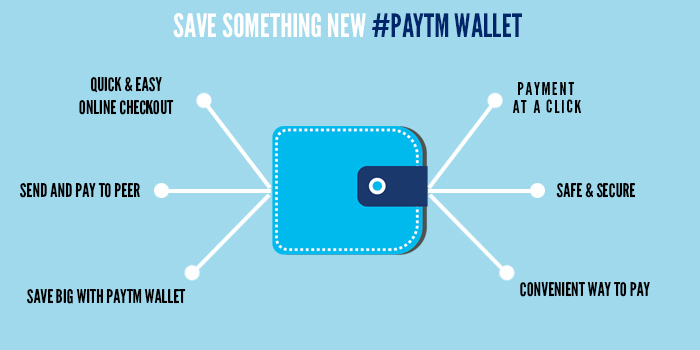

This resulted in a sudden upsurge in the use of e-wallets like PayTM because they allowed users to make payments without having the physical notes. This helped the people in the time of need. However, there are still many people who have not been able to use it.

Also see :- Nearby feature launched on the app amidst cash crisis in the nation.

Are you also unaware of its usage? Do you also no idea about how to make and receive payments with PayYTM? Do not worry. You are not alone. There are many people in the nation who still do not use it because they do not know how to do so. That is why we decided to write about it to help you in every possible way.

How to download PayTM

If you want to download PayTM on your smartphone, follow these steps:-

- Open Play Store.

- You will see a white box on the top of the screen. Click on it.

- Type PayTM and hit

- Click on the first search result.

- Hit the Install

Congratulations! You have just downloaded the PayTM app. Please note that after you click on install, it will first download and then be installed on your phone. The time taken to download depends on your internet plan.

How to pay bills with PayTM

Once you have downloaded the PayTM app, you can make your payments with it. How to do so is explained ahead:-

- Open the PayTM app.

- Create an account by filling in your details like e-mail address and mobile phone number.

- Once you have made your account, you need to add some money to it for making payments. You can do so by net banking or by using your credit/debit card for the same.

- Once you add some money to your account, you can start making payments everywhere where the seller or merchant accepts PayTM as a way of making payments.

Once it is done, you can make all sorts of payments and recharges. This includes electricity bill, recharges (phone and DTH), gas bills etc. It also allows you to book tickets for buses, trains, flights, movies, hotel rooms etc.

What else?

Apart from making payments, you can also use PayTM to purchase a lot of goods from a wide array of merchants that are selling via PayTM. You can purchase these products by making the payment with the help of PayTM wallet.

In the wallet, you can add up to Rs.10,000 in a month. If you want to add more than you use the Know Your Customer (KYC) verification process and add up to Rs.1 lakhs at any given point of time.

That’s all for now. If you have any other queries relating to PayTM or any of its functionalities, feel free to contact us. We will try to help you as much as we can. Stay tuned for more updates.