The Government of India is looking very much committed to implementing the Goods and Service Tax (GST), which could prove out to be an economical revolution in Indian Economy. And after getting GST Bill clearance from parliament, the Union Cabinet has cleared the Council to fix the rates. To meet the April deadline, the centre could need to look at convening the winter session of parliament by the first week of November, a fortnight earlier than usual, sources said.

This is another big step towards meeting the April 1, 2017, deadline to implement the mega reform Goods and Services Tax Bill. And on Monday, the Union Cabinet has today approved the setting up of a GST Council which will fix the rate of the single tax that will replace a slew of indirect taxes across the country. This follows President Pranab Mukherjee’s nod last week to the bill that amended the Constitution to enable the biggest tax reform since Independence.

What will the GST Council decide and its meetings ?

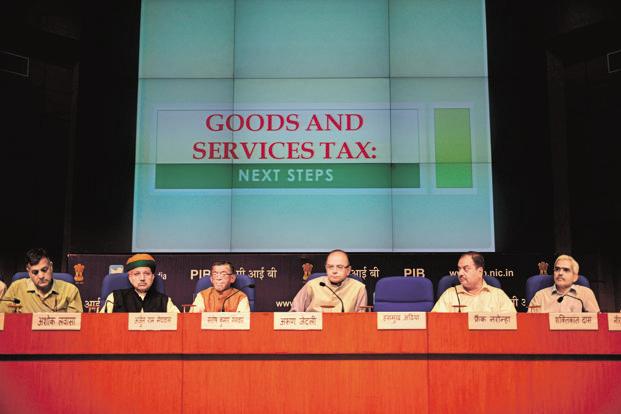

The first meeting of the GST council, which will have finance ministers from states as its members and will be chaired by Union Finance Minister Arun Jaitley, will be held on September 22 and 23, the government said in a release. “We are so far ahead of time schedule in implementing Goods and Service Tax,” said Revenue Secretary Hasmukh Adhia.

The council will decide on the tax rate, which is still a point of contention, will recommend the basket of taxes that GST will replace and the ones that will be kept out and will also recommend the contours of a dispute resolution mechanism. The Council will also decide if GST will have different slabs – a lower rate for essentials and a higher one for what are seen as luxury goods and one for services.

However, Jayalalitha’s AIADMK Could create hurdles in fixing rates

Since both houses of parliament passed the bill unanimously in the monsoon session last month, 17 states have ratified GST. It needed 15, or half of India’s 29 states to approve it. Tamil Nadu’s ruling AIADMK had opposed GST and walked out before the voting began on the Bill in both houses. But, now is when it could get into rougher waters. While opposition parties are united in demanding that the standard GST rate be capped at 18 percent, the states want it closer to 20 percent to increase their revenues.

Two related bills have to be presented for Parliament’s approval then – the crucial Central Goods and Service Tax or CGST bill which will make it a law and the Integrated GST Bill. States will meanwhile approve their own GST bills. The CGST bill will be based on the recommendations of the GST council and opposition parties will insist that it fixes the rate of GST.