Lucky Grahak Yojana: The center government has started numerous steps to control the curse of corruption and black money over the past two and half years. Union government has recently approved a slew of initiatives in February 2016 to motivate people for digital payments and a transition these measure in his Man Ki Baat address in May 2016. He had urged people to adopt cashless transactions. He said “If we learn and adapt ourselves to use cashless transactions, then we will not require notes

In order to increase overall transparency in the economy and to remove the malicious impact of cash on the political and economic system, it is impetuous that we take a longer-term view and bring in measures that would influence the behaviors of the consumers as well as merchants to shift to digital payment instruments.

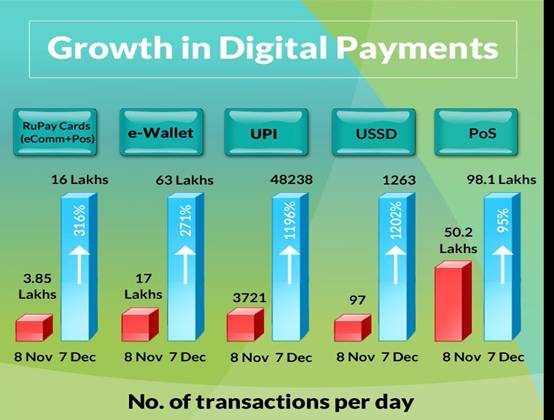

Incentives to encourage digital payments. pic.twitter.com/08rXJwQwoM

— PMO India (@PMOIndia) December 9, 2016

A country like India where 65 percent of the population is below 35years of age, whose IT expertise is well recognised and where even poor and illiterate people exercise their franchise through EVMs.

NITI Aayog announces the launch of the schemes Lucky Grakah Yojana and the Digi-Dhan Vyapar Yojana to give cash rewards to consumers and merchants who use digital payment instruments for personal and commercial purposes.

The schemes specially focus on bringing the poor, lower middle class and small businesses into the digital payment fold. It would be useful to repeat that NPI is a not for profit company which is charged with a responsibility of guiding India towards being a cashless society.

The basic motive of the scheme “Lucky Grahak Yojana” is to incentivize digital transaction to connect society, especially the poor and the middle class. The government has designed keeping in mind all section of the society and their usage patterns. For example, the poorest of poor will be eligible for rewards by using USSD. People from the village and rural areas can participate in this Lucky Grahak Yojana scheme through AEPS.

The scheme will become operational with the first draw on 25th December 2016 (as a Christmas gift to the nation) leading up to a Mega Draw on Babasaheb Ambedkar Jayanti on 14th April 2017. It will comprise of two major components, one for the Consumers and the other for the Merchants:

- Lucky Grahak Yojana (Consumers):

- Daily reward of Rs 1000 to be given to 15,000 lucky Consumers for a period of 100 days;

- Weekly prizes worth Rs 1 lakh, Rs 10,000 and Rs. 5000for Consumers who use the alternate modes of digital Payments

This will include all forms of transactions viz. UPI, USSD, AEPS and RuPay Cards but will, for the time being, exclude transactions through Private Credit Cards and Digital Wallets.

Digi-DhanVyapar Yojana (Merchants):

- Prizes for Merchants for all digital transactions conducted at Merchant establishments

Weekly prizes worth Rs. 50,000, Rs 5,000and Rs. 2,50

Mega Drawn 14th of April – Ambedkar Jayanti

- Mega Prizes for consumers worth Rs 1 Cr, 50 lakh, 25 lakh for digital transactions between 8th November 2016 to 13th April 2017 to be announced on 14th April 2017

- 3 Mega Prizes for merchants worth Rs 50 lakhs, 25 lakh, 12 lakh for digital transactions between 8th November 2016 to 13th April 2017 to be announced on 14th.

The focus of the scheme is on a small transaction, incentives shall be top secret to transactions within the range of Rs 50 and Rs 3000. All transactions amid consumers and merchants, consumers and government agencies and all AEPS transactions will be measured for the incentive scheme.

The winners will be chooses through a random draw of the eligible Transaction IDs which are generated automatically as soon as the transaction is completed. For this, special software is developed by NPCI for this purpose. The government has directed NPCI to make sure a technical and security audit of the same to assure that the technical integrity of the process is maintained.

In the first phase of the scheme, the estimated expenditure is expected to be 340 crores. The government will altogether carry out a review form a cash user society to a cashless society