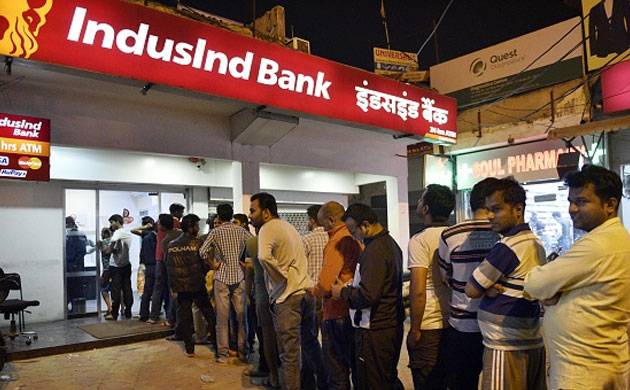

Cash withdrawal limit

After the demonetization of Indian currency, Government is currently taking baby steps to restructure the whole economy. On Sunday, Cash withdrawal limit increased in ATM’s to Rs. 2500 per day which earlier was Rs. 2000 per day. The chaos and frustration among the public, which is under the brunt of exchanging the old notes for new ones is increasing day by day which tempted the government to take this step.

Relief for public

Cash withdrawal limit increase brought some cool breeze for public. Banks are being advised to raise the counter exchange limit from Rs. 4000 to Rs. 4500. This will automatically increase the weekly limit of Rs. 20000 to Rs. 24000 and the limit of Rs. 10000 per day has been removed. The finance ministry is in talks with RBI, banks and post offices to make all notes denominations at all places and is also scrutinizing that notes are being properly distributed among public. Finance ministry said in a statement, “Banks have also been specially advised to ensure availability and distribution of small denomination notes. Coordination is being continuously done by the ministry of finance with RBI, banks and post offices to make all denomination notes available at all locations”.

Special Exemption

Moreover, cash withdrawal limit increased for patients who are under treatment and those who have planned marriages are given special exemptions where the limit doesn’t come into effect. The administration will take strict actions against those people or businesses that are harassing the patients or families who have marriages at their house. In that case, caterers, tent houses, private or government hospitals will be under strict vigil.

Bank mobile vans into action

Banks are being advised to start mobile vans near hospitals so that the transaction process can be eased for patients, senior citizens and handicapped persons. The cash withdrawal limit has also been raised for these people.

Cash withdrawal limit came down when demonetization came into effect after government banned 500 and 1000 rupee notes from 8th November.