Unfazed by reports that he might have avoided paying income tax for up to 18 years, Republican presidential nominee Donald Trump has acknowledged that he “brilliantly used” tax laws to pay as little tax as legally possible.

US Presidential Elections 2016 has seen many other major issues to talk about, but both the presidential nominees from Republicans and Democrats tried really hard to hit on each other rather than talking about the policies for the future of the United States.

Whereas the email leaks of Hilary Clinton was raised again and again by the Republicans Nominee Donald Trump. He raised the questions marking a serious security threat to the US. In the counter-attack Democrats Nominee, Hilary Clinton always used to raise the issue of making public the Tax records of Donald Trump.

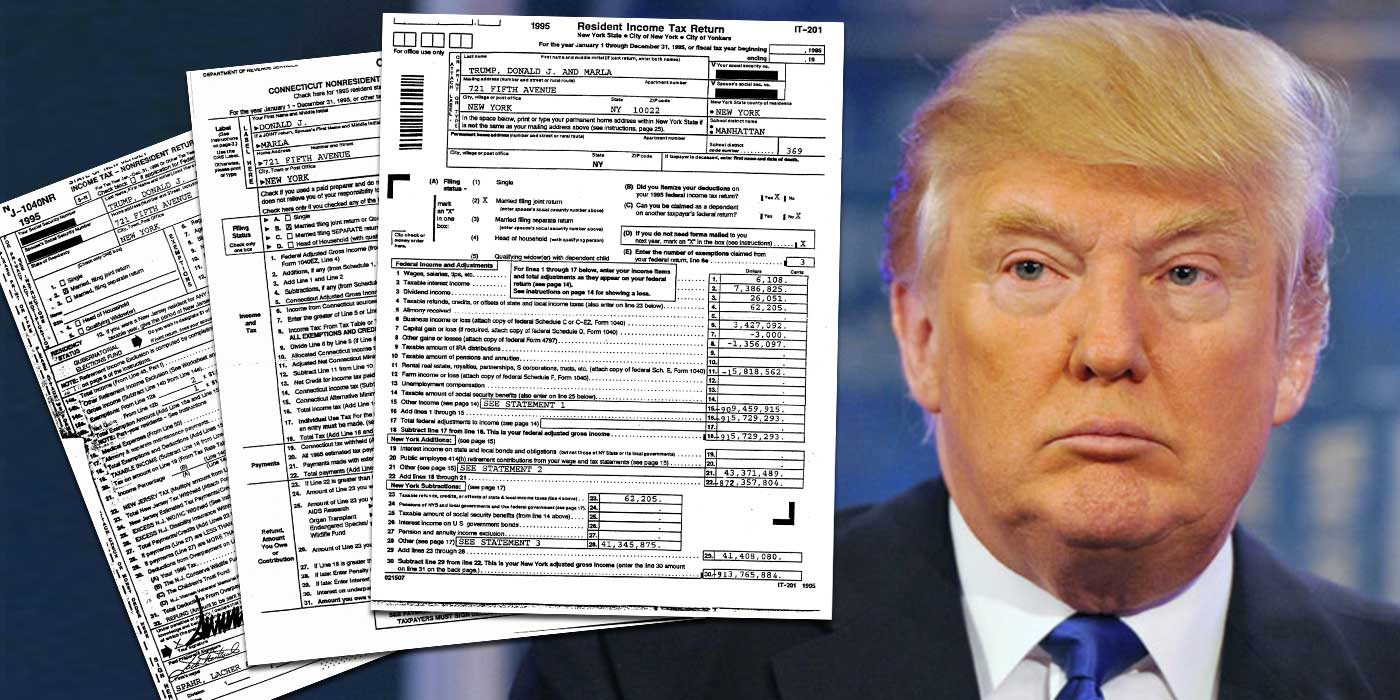

Finally, Donald Trump accepted the fact that he paid the lesser tax as earlier New York Times also published the taxpaying records of Donald Trump that shows that he paid the lesser taxes. According to News article in NYT, in 1995 Trump declared a loss of nearly a USD 1 billion. As a result of which the New York Times said Trump might not have had paid income tax for 18 years.

So the question raises that did Trump admitted this because of the public pressure or to present his image of a brilliant businessman? And will this be going to help him or hurt him?

At a series of public meetings, Trump appeared to be unperturbed by the latest revelation that he might not have had paid income taxes for as many as 18 years.

What Donald Trump said according to the reports of admitting paying lesser taxes?

“As a businessman and real estate developer, I have legally used the tax laws to my benefit, and to the benefit of my company and my employees. I have often said on the campaign trail, that I have a fiduciary responsibility to pay no more tax than legally require like anyone else. Or, put another way, to pay as little tax as legally possible,” Trump said at an election rally in Colorado.

“I mean, honestly, I have brilliantly — I have brilliantly used the laws and often said on the campaign trail that I have a fiduciary responsibility to pay no more tax than is legally required like anybody else. Or, put another way, to pay as little tax as legally possible. And I must tell you, I hate the way they spend our tax dollars,” Trump said.

As a major real estate developer in this country, and throughout the world, Trump said he face enormous taxes: city taxes, state taxes, sales and excise taxes, employee taxes, and federal taxes.

It’s my job to minimise the overall tax burden to the greatest extent possible – which allows me to reinvest in neighbourhoods, workers, and build amazing properties which fuel tremendous growth in their communities – and always help our great providers of jobs, the small business,” he argued. The Trump campaign has not disputed the authenticity of the report. Trump said his loss came as a result of an economic recession in the 1990s.

The Trump campaign has not disputed the authenticity of the report. Trump said his loss came as a result of an economic recession in the 1990s.

“The conditions facing real estate developers in the early nineties were almost as bad as the Great Depression of 1929 and far worse than the Great Recession of 2008,” he said.