The online mode of payment of income tax has made it a lot easier to e-file the tax return. With this, the hassle of a layman has considerably reduced and now its a lot easier to file tax online. If your income is above Rs 5,00,000 it is mandatory for you to file tax return online. In this article we will tell you 10 easy steps to fill income tax returns online.

The need of the tax consultants and other intermediaries has enormously reduced with the e-filing of taxes.

Follow these steps to fill income tax returns online:

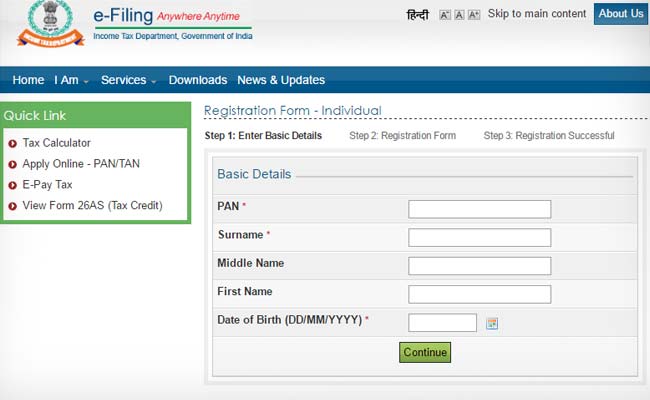

- First of all, visit the income tax portal of the Income Tax Department. Now register with your Permanent Account Number (PAN) which will work as your user id. If you already have an account, just log in with your details.

- Now, there are two options to file the tax return. For the first option, you have to go to the download section. Now select the required form and choose the “save” option. Then fill in all the details. Now click on “generate XML” and visit the site again and upload XML. Then submit the form.

- You can also go to the “quick e-file” option provided in the website. Now log in and select the form and choose the appropriate assessment year for which you are filing tax return. Now fill in the form with the required details.

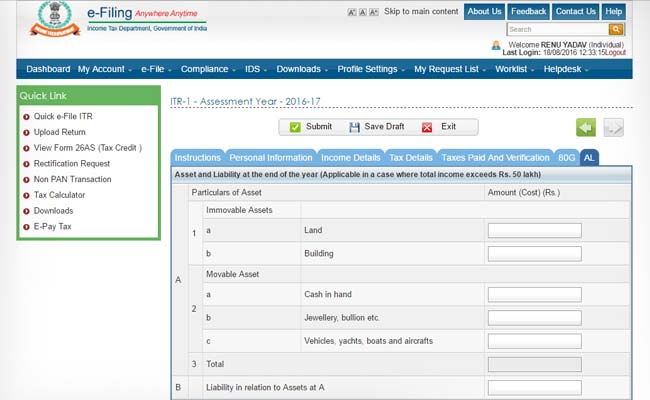

- Different forms are available on the site for different individuals, varying as per their source of income. Select ITR-1 form in case your source of income is salary, pension, income from property or other sources except lottery. Select ITR-2 in case your source of income is capital gains.

- Make sure that you already have the pre-requisites with you before filing the tax return such as Permanent Account Number, Form 16, TDS details (Tax deducted at source) and interest statement.

- If your income is Rs 50,00,000 or above then you will have to fill in the details in the “AL” section. This section is a new addition in the e-filing mode of tax return.

- Now download 26AS form which is your tax statement depicting the total amount of tax that you have paid against you PAN id.

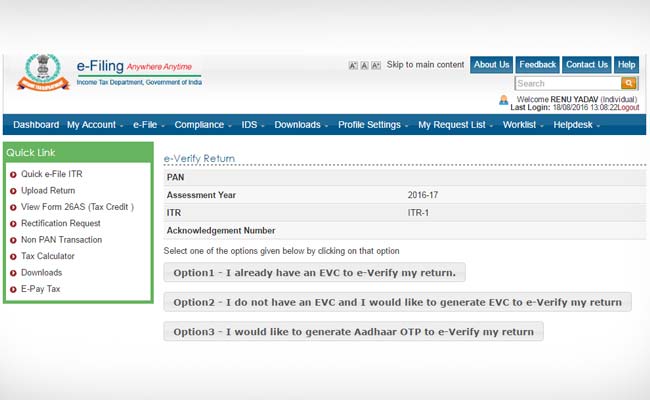

- ITR-V will be then sent at your registered e-mail address if you have submitted the form without using digital signature. This is the acknowledgement of your tax return. And is you have used a digital signature, an acknowledgement number is generated.

- Within 120 days of e-filing the tax return, you are required to send the ITR-V to the Centralised Processing Center which is located in Bengaluru.

- Or you can just e-verify your tax return using your Aadhaar Card or through net-banking.

In case you are facing any issues while e-filing the tax returns, follow these steps to fill income tax returns online.