Mudra Bank Loan Yojana: The central government has launched several schemes to assist the needy and Mudra Loan Yojana/ Pradhan Mantri Mudra Yojana is one of PM Modi’s ambitious schemes. The basic motive of this scheme is to make people financially strong by giving loan assistance for several needs at economical interest rates.

Depending on the size of their venture loans are being offered accordingly. Under the scheme, the government is committed to offering loan up to 10 lakh. The Mudra loans have been divided into three categories such as Shishu loan, Kishore Loan, and Tarun Loan. To scroll down more to know how to apply for the loans, procedure, and other key information:

To run smoothly, every business should be financially strong. Established businessman can manage his business in all financial crises, however, the start-ups or entrepreneurs need financial assistance. And, the government came out for the same to make their business roots strong by launching the various schemes for the benefit of the emerging businessmen in the business world.

We at Northbridgetimes.com have brought the essential details about Mudra Loan which can help you to get the loan and to understand the conditions. As there are a variety of loans and you need to know about them to choose the best one that meets your requirements.

MUDRA BANK LOAN YOJANA – Details and Process

In India, there are numerous small organizations, companies, and startups. All these are collectively known as Micro Units. It has been observed that they are lacking with financial support. If the financial support is given they can grow and enhance their reach.

MUDRA is known as Micro units Development and Refinance Agency Ltd is an institution that has been introduced by Indian Government. MUDRA Bank has been set up with only one goal in mind to fulfill the needs of the non-corporate small business with funds.

Here is the information regarding applying to the Mudra Bank Loan Yojana for Shishu, Kishor, and Tarun:

- You need to visit the Private or Commercial bank nearest to your location if you are looking for a loan under PMMY

- Present your business idea along with the Loan Application and the form you need to provide proof of identity, Address, and recent passport size photographs

- Borrowers have to be filled all formalities as per the bank instructions.

- After completion of all the steps, you will be eligible to take a loan.

PMMY Pradhan Mantri Mudra Yojana – MUDRA Bank Helpline

To clear any doubts, queries regarding the scheme, you can contact the helpline on help@mudra.org.in

Responsibilities of MUDRA Bank loan Yojana

- Preparing and Launching the Policy Guidelines

- Registration and Regulation of MFI Entities.

- Running a Credit Guarantee Scheme

- Creating a Good Architecture for serving Micro business by providing them Loan (Financial Assistance)

Mudra bank loan Yojana – SHISHU, KISHOR & TARUN CATEGORIES

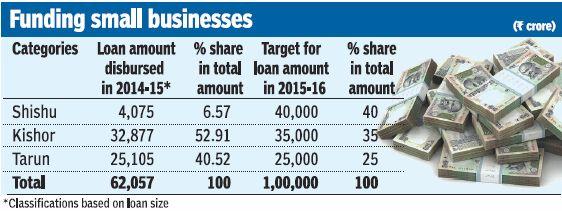

Micro units or small business had to be categorized to indicate the growth stage, Development and Funding requirements. Three categories were created for this purpose Namely “Shishu(Child Category)”, “Kishor Category” and “Tarun Category”.

For finding out in which category your business falls, here are the details of each category:

Shishu (Child) category –This category is for the Start-ups. All those businesses that have been just initiated and looking for Loan will consider the category. A total amount of Rs 50,000 under the loan scheme will be given to all small businesses and will fall in this category too. Interested Rate for this class is in the range of 10 to 12 percent.

Kishor Category – This scheme is for those who have started their business and established yet. Such businessmen can get loan Rs 50, 0000 to 5 lakhs. And, the interest rate in Kishore category is in the range of 14-14 percent.

Tarun Category– All the established business will be considered in this category. There may be some financial requirements for the enhancement of business. This is why all small business or units falling into this category will be eligible for a Loan cover up to Rs 10 lakh and the interest of at least 16 percent will be paid by them.

Eligibility Criteria for Participating Banks and Financial Companies –

Scheduled Commercial Banks –

All scheduled commercial Banks in public and private sector with 3 years of continuous profit track record, net NPAs not exceeding 3%, minimum net worth of Rs.100 Cr. and not less than 9% CRAR are eligible to Lend Loan

Regional Rural Banks

All restructured RRBs having net NPA within 3% ( relaxable in deserving cases), having profitable operations and not carrying any build up losses and CRAR 9% are eligible under Pradhan Mantri Mudra Scheme.

MFI, Small Business companies are also eligible if they fulfill the requirement.

Modi ji 3 lakĥ rupye lon chahye pleej /(gonda colonelganj up

Sir ghar keliye kujh laon chahiye plz plz sir my no7355776298

sir i m vary hardwarkars

Mujhe mudra loan Lena hai, sir

Dear sir I am hardworking man but I haven’t capital & bankar are don’t finance in mudra yojna scheme & I haven’t a plot. So help me sir. I am trouble.

I went in each nand every bank but all the bank staff are telling they don’t provide mudra loan sir I need plzzz help