The Reserve Bank of India (RBI) has issued a circular yesterday to cater to the numerous problems that have arisen post the demonetisation drive to sort out the black money problem in India. In the circular, they have cleared that the mobile wallet limit has been raised to Rs.20,000.

Any service which allows you to add money to it that can be used later for financial transactions has been termed as Prepaid Payment Instrument (PPI). For the regular users, the limit on these services was Rs.10,000 per month which has now been doubled to Rs.20,000.

More about new mobile wallet limit

This means that all the mobile wallets, digital wallets and smart cards etc can now be stuffed with more cash now. Instead of Rs.10,000, you can transfer up to Rs.20,000 into these services every month. All other rules and regulations surrounding the PPI remain unchanged.

Also see :- PayTM launched Nearby Feature in India in light of demonetisation.

There is also a special provision for small merchants. The PPI service providers will have to register the small merchants and then verify their bank accounts. Once that is done, the limit on transfer amount from PPI to banks will be revised to Rs.50,000 a month. Also, there will be no limit on the amount which can be transferred in a single transaction.

However, the amount of money that can be loaded on the PPI still stands at Rs.20,000 for them as well. This means that basically, the maximum possible transaction to a bank account from a PPI owned by a small merchant is Rs 20,000. The inflow of money to the merchant account is currently limited to sale transactions.

Why mobile wallet limit has been raised

Mobile wallets or e-wallets like PayTM, FreeCharge etc are being widely used right. The reason behind this is that the country is literally cash-starved right now. The limits have been doubled in light of the numerous problems that the people are facing right now. This move will be of great help to people who are in dire need of cash and cash is something which is hard to come by nowadays.

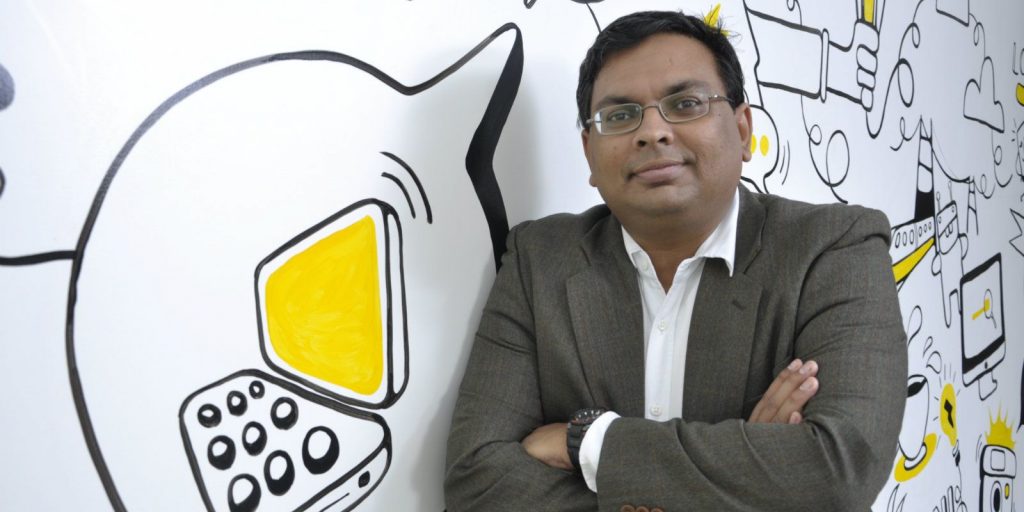

Govind Rajan, CEO – FreeCharge commented on the raised mobile wallet limit and said, “FreeCharge welcomes RBI’s decision to increase the limits on wallets to Rs 20,000 for users and to Rs 50,000 for merchant bank transfers. This doubling of limits will have an immensely beneficial impact for users and small merchants. Given the quantum jump in digital wallets usage in recent days, this increase in limits makes it easier for both users and merchants to shift more of their cash transactions to digital wallets. The progressive policies of the RBI and the government’s prompt resolution of industry issues will go a long way in building a cashless India.”

The rules relating to increased mobile wallet limits are now in effect in the country. The new rules will sustain till December 30, at which point they will be reviewed. After the review, they could be implemented for the long haul or we could see a rollback to the previous set of rules. Stay tuned for more updates.