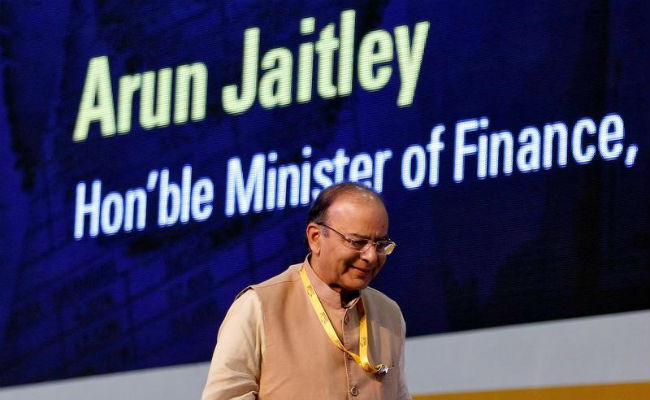

Union Budget 2017: The Finance Minister Arun Jaitley presented the fourth Annual Budget today in the parliament. FinMin has revealed some of the Union Government’s plans to introduce new schemes in various sectors. While many inclusions have been made keeping in view the demonetisation policy of the government that had hit the country’s masses badly, many products will now be costlier as well.

Union Budget 2017

For the income tax, the Modi-led government ahs opted for a system that makes the rich pay more than the poor.

Here are some of the important changes that will come into effect as a result of Union Budget 2017 –

More job creation will be there for women as announced by the Finance Minister.

A tax relief has been introduced in the new budget. There were expectations for the same. Now an individual having an income of Rs 3.5 lakhs will have to pay an income tax of Rs 2575 while earlier the amount was Rs 5150.

While those having a taxable income of Rs 5 lakh to Rs 50 lakh will have to pay Rs 12875 or lesser.

Those with an income of Rs 50 lakh to Rs 1 crore will have to pay a surcharge of 10 percent on the total payable tax amount.

Furthermore, those having an income over Rs 1 crore will have to pay a surcharge of 15 percent on the total tax amount payable.

Also Read: Union Budget 2017 – Here are the highlights of FinMin’s Budget for this year

The Union Budget 2017 when fully implemented will make many of the products costly while some of the products will be available at the lower price than before.

Here is a list of products that will become costlier after the implementation of the Union Budget 2017 –

Cigarettes, Bidis, Pan masala and chewing tobacco will now become costlier.

Cashew nuts will also be expensive than before; both salted and roasted.

Components of the LED Lamps – costlier.

Aluminium ores and Concentrates – costlier.

Polymer coated MS tapes – costlier.

Silver coins – costlier.

Mobile Phones – costlier.

Here is a list of products that will become cheaper after the implementation of the Union Budget 2017 –

Booking of railway ticket online – cheaper.

RO Membrane for household use – cheaper.

Tempered glass used in the solar panels – cheaper.

Liquefied Natural Gas – cheaper.

Point of sale machine fingerprint readers – cheaper.

Group Insurance for the defence services – cheaper.

Energy Generator operated by wind – cheaper.